Medium Term - COAL INDIA Ltd - Target 241/263 - Rupeedesk Shares - 22.08.2022

Free Stock - Nifty Tips - RupeeDesk

Free Stock and Nifty Tips ,Share Market,Bseindia,BSE,NSE India,Live Market Quotes,Online Trading,Stock,rupeedesk Exchange,Share,rupeedesk Prices,Stock Market Quotes. (Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in)

Rupeedesk Head

Medium Term - COAL INDIA Ltd - Target 241/263 - Rupeedesk Shares - 22.08.2022

Why Amul is not listed on the stock market ?

Why Amul is not listed on the stock market ?

Source : Instagram : wallstreetmojooffcial

PIDILITIND Stock Analysis - Rupeedesk Reports - 20.06.2022

PIDILITIND Stock Analysis - Rupeedesk Reports - 20.06.2022

Top Weightage Stocks Trend Rupeedesk Reports - 16.06.2022

Top Weightage Stocks Trend Rupeedesk Reports - 16.06.2022

BCG Stock Analysis - Rupeedesk Reports - 07.06.2022

BCG Stock Analysis - Rupeedesk Reports - 07.06.2022

IBULHSGFIN Stock Analysis - Rupeedesk Reports - 03.06.2022

IBULHSGFIN Stock Analysis - Rupeedesk Reports - 03.06.2022

BHARATFORG Stock Analysis - Rupeedesk Reports - 31.05.2022

BHARATFORG Stock Analysis - Rupeedesk Reports - 31.05.2022

SHILPAMED Stock Analysis - Rupeedesk Reports - 24.05.2022

SHILPAMED Stock Analysis - Rupeedesk Reports - 24.05.2022

ASHOKLEY Stock Analysis - Rupeedesk Reports - 20.05.2022

ASHOKLEY Stock Analysis - Rupeedesk Reports - 20.05.2022

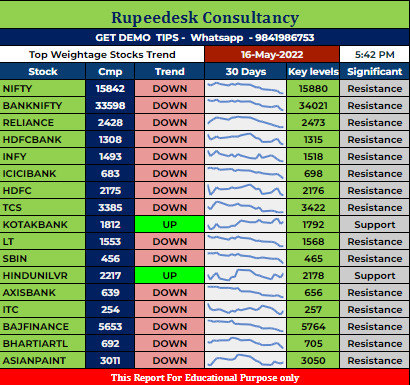

Top Weightage Stocks Trend Rupeedesk Reports - 16.05.2022

Top Weightage Stocks Trend Rupeedesk Reports - 16.05.2022

GODREJCP Stock Analysis - Rupeedesk Reports - 13.05.2022

GODREJCP Stock Analysis - Rupeedesk Reports - 13.05.2022

PVR Stock Analysis - Rupeedesk Reports - 10.05.2022

PVR Stock Analysis - Rupeedesk Reports - 10.05.2022